does unemployment reduce tax refund

When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020. WASHINGTON The Internal Revenue Service today reminded taxpayers how to avoid common errors on their tax returns.

An Independent Contractor Is A Person Or Entity That Contracts With Another To Perform A Particular Task Business Tax Independent Contractor Education Poster

You cant get that over-withheld income tax back until after the end of the year.

. That May Reduce EITC Refunds Next Spring. A large tax refund will not affect your unemployment benefits. Is There a Tax Break on Unemployment Benefits Received in Tax Year 2021.

The American Rescue Plan Act ARPA allowed some taxpayers to deduct from income up to 10200 of unemployment benefits on their 2020 tax return. Unemployment Benefits Are Taxable Income. The deduction is subject to the limit of 2 of your adjusted gross income AGI.

Couples can waive tax on up to 20400 of benefits. 2021-22 Board of Directors. The second phase includes married couples who file a joint tax return according to the IRS.

The American Rescue Plan Act which was signed on March 11 included a 10200 tax exemption for 2020 unemployment benefits. Unemployment refunds are scheduled to be processed in two separate waves. If so how do I get notification this was done because my amount owed to me was less then what I was to get.

You had to qualify for the exclusion with a modified adjusted gross income MAGI of less than 150000. The second wave will recalculate taxes owed by taxpayers who are married and filing jointly as well as individuals with more complicated. BUT the first 10200 of.

If you owe unemployment compensation to the state because the state believes that you were previously overpaid then yes the IRS can take part or all of your refund if the state asks. Unemployment benefits are taxable. One of the provisions in the plan was that taxes on up to 10200 in unemployment benefits would be waived for people earning less than 150000 a year.

Yes they can take both state and federal refundsState Unemployment Insurance Compensation debts are now eligible for referral to Treasury Offset Program. To avoid errors on these common credits there are. This filing season the IRS is seeing signs of a number of common errors including some taxpayers claiming incorrect amounts of the Recovery Rebate Credit and Child Tax Credit.

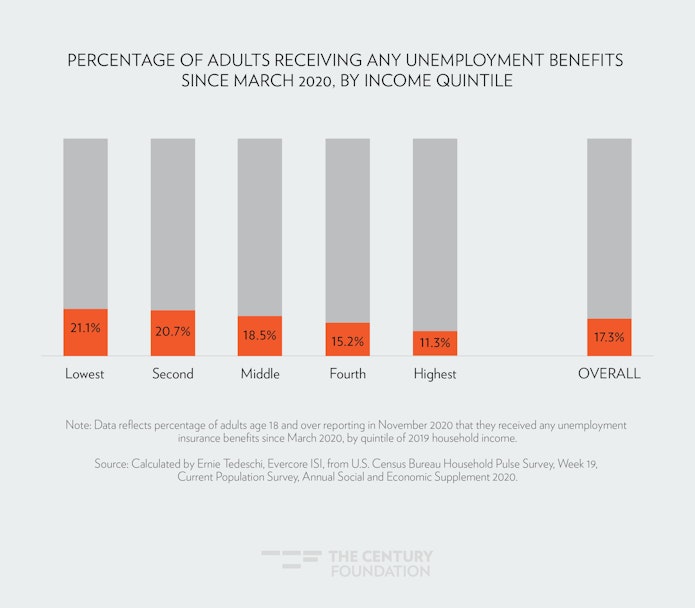

The IRS has already sent out 87 million. Unemployment compensation is not considered earned income for the Earned Income Tax Credit EITC childcare credit and the Additional Child Tax Credit calculations and can reduce the amount of credits you may have traditionally received. When you get laid off and make far less over the year you may get a large portion or all of your income tax withheld back as an unemployment tax refund.

The exemption which applied to federal taxes meant that unemployment checks sent during the pandemic werent counted as earned income. Can unemployment take money from federal refund. The IRS is taking money away from people who received unemployment benefits.

Compare the results and use the method deduction or credit that results in less tax. What are the unemployment tax refunds. This means you dont have to pay tax on unemployment compensation of up to 10200 on your 2020 tax return only.

With The Latest Batch Uncle Sam Has Now Sent Tax Refunds To Over 11 Million Americans For The 10200 Unemployment Compensation Tax Exemption. Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463 or 860-297-5962. Federal agency non-tax debts.

If the amount of unemployment repayment is more than 3000 calculate the tax under both of the following methods. The Department of Treasurys Bureau of the Fiscal Service BFS issues IRS tax refunds and Congress authorizes BFS to conduct the Treasury Offset Program TOP. The IRS will issue refunds in two phases.

If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan Act enacted on March 11 2021 allows you to exclude from income up to 10200 of unemployment compensation paid in 2020. How is Income Tax Paid on. Tax on up to 10200 of unemployment.

If you received unemployment benefits last year and filed your 2020 tax return relatively early you may find a check in your mailbox soon. If someone properly claimed unemployment benefits and overpaid the taxes on them the resulting refund could be reduced to satisfy unpaid government debt or unpaid child support she said. Many low- and moderate-income households no doubt were assisted greatly by enhanced federal Unemployment Insurance benefits that they received earlier this year and would be thrilled to receive a second roundif Congress and President Trump ever agree on a new pandemic.

It will start with taxpayers eligible to exclude up to 10200 of unemployment benefits from their federal taxable income. Through the TOP program BFS may reduce. The Department of Treasurys Bureau of the Fiscal Service BFS issues IRS tax refunds and Congress authorizes BFS to conduct the Treasury Offset Program TOP.

These are considered regular income and youll get a W-2. Because unemployment benefits are not considered earned income receiving unemployment rather than wages or salary may reduce. This refund may also be applied to other taxes owed.

While taxes had been waived on up to 10200 received in unemployment for those making less than 150000 in 2020 -- the first year of the pandemic -- that was only temporary relief and no such. You will need your social security number and the exact amount of the refund request as reported on your income tax return. The first wave will recalculate taxes owed by taxpayers who are eligible to exclude up to 10200.

Through the TOP program BFS may reduce your refund overpayment and offset it to pay. If both members of a married couple were receiving unemployment they could both deduct up to that amount. Individuals should receive a.

The new tax break is an exclusion workers exclude up to 10200 in jobless benefits from their 2020 taxable income.

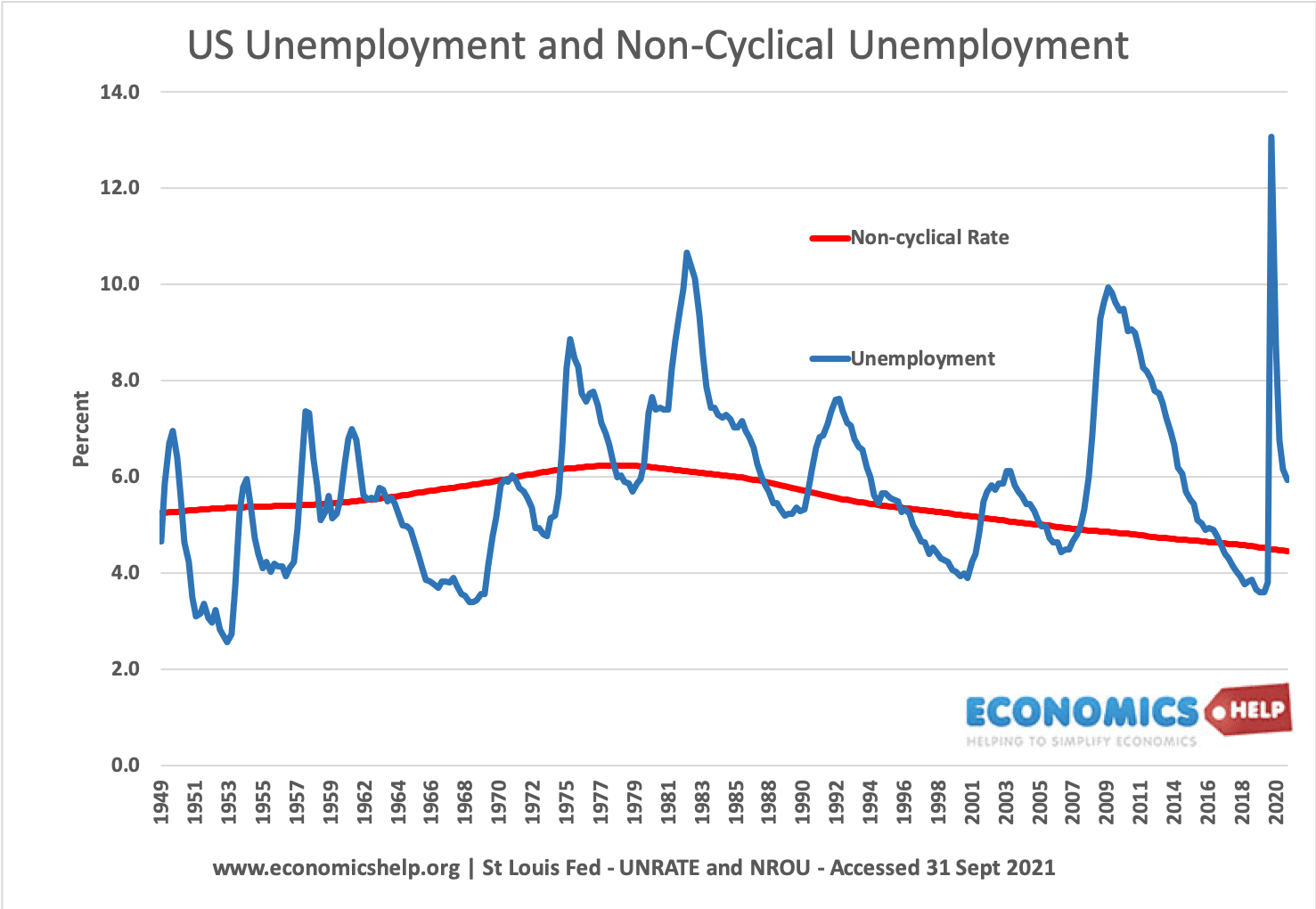

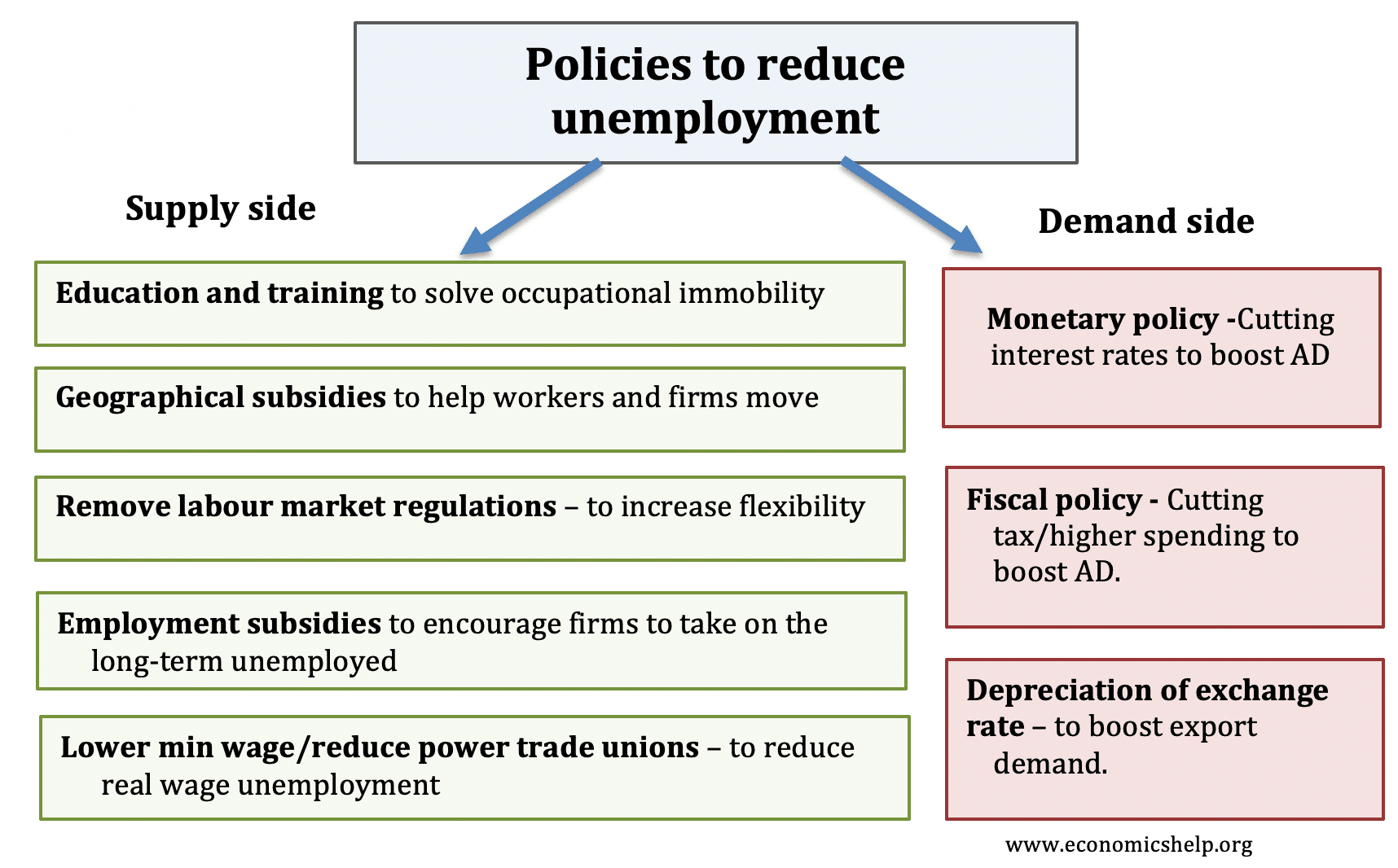

Policies For Reducing Unemployment Economics Help

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Policies For Reducing Unemployment Economics Help

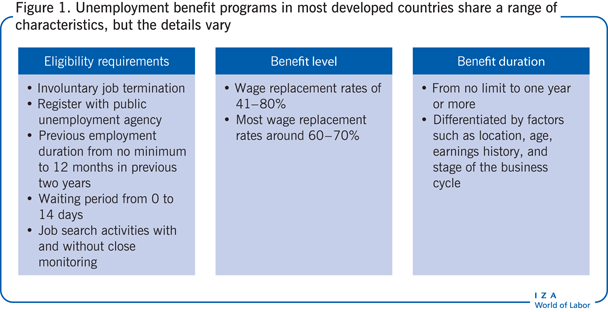

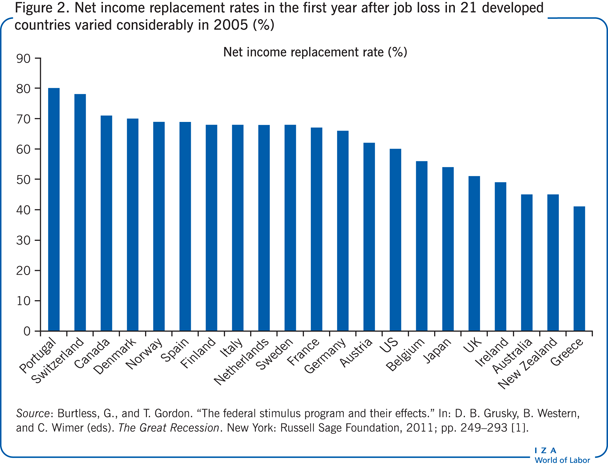

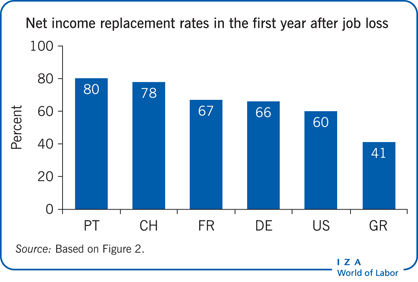

Iza World Of Labor Unemployment Benefits And Unemployment

Iza World Of Labor Unemployment Benefits And Unemployment

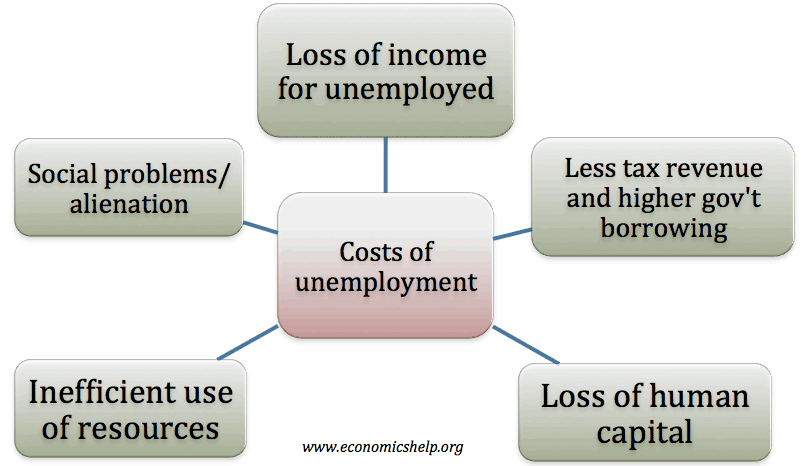

Economic Costs Of Unemployment Economics Help

:max_bytes(150000):strip_icc()/UnemploymentandGDP2008-80ffa8c6bee640208888f8cc26cb38e2.jpg)

What Happens To Unemployment During A Recession

Career Connection Is The Name Of Aspire S Supported Employment Program They Help Reduce The Cost Of Public Support For People Facin Supportive Employment Self

4 Steps Young People Can Take To Start Building Wealth Even In A Recession In 2022 Investing Financial Aid For College Financial Aid

Iza World Of Labor Unemployment Benefits And Unemployment

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Policies For Reducing Unemployment Economics Help

How Is Unemployment Taxed Forbes Advisor Forbes Advisor

Fikr12 The 12th Annual Arab Thought Foundation Conference Under The Theme A Road Map For Job Creation 80 Million Job Marketing Jobs Online Jobs Job Opening

If You Fall Into Any Of These Categories You May Not Get Your Money Debt Taxes Tax Refund Tax Debt Child Support Payments

How Inflation And Unemployment Are Related

Tax Refunds On Unemployment Benefits Still Delayed For Thousands